Already a subscriber? Make sure to log into your account before viewing this content. You can access your account by hitting the “login” button on the top right corner. Still unable to see the content after signing in? Make sure your card on file is up-to-date.

The Consumer Financial Protection Bureau (CFPB) has introduced a regulation aimed at significantly reducing credit card late payment fees, promising a 75% cut that could save US consumers roughly $220 annually.

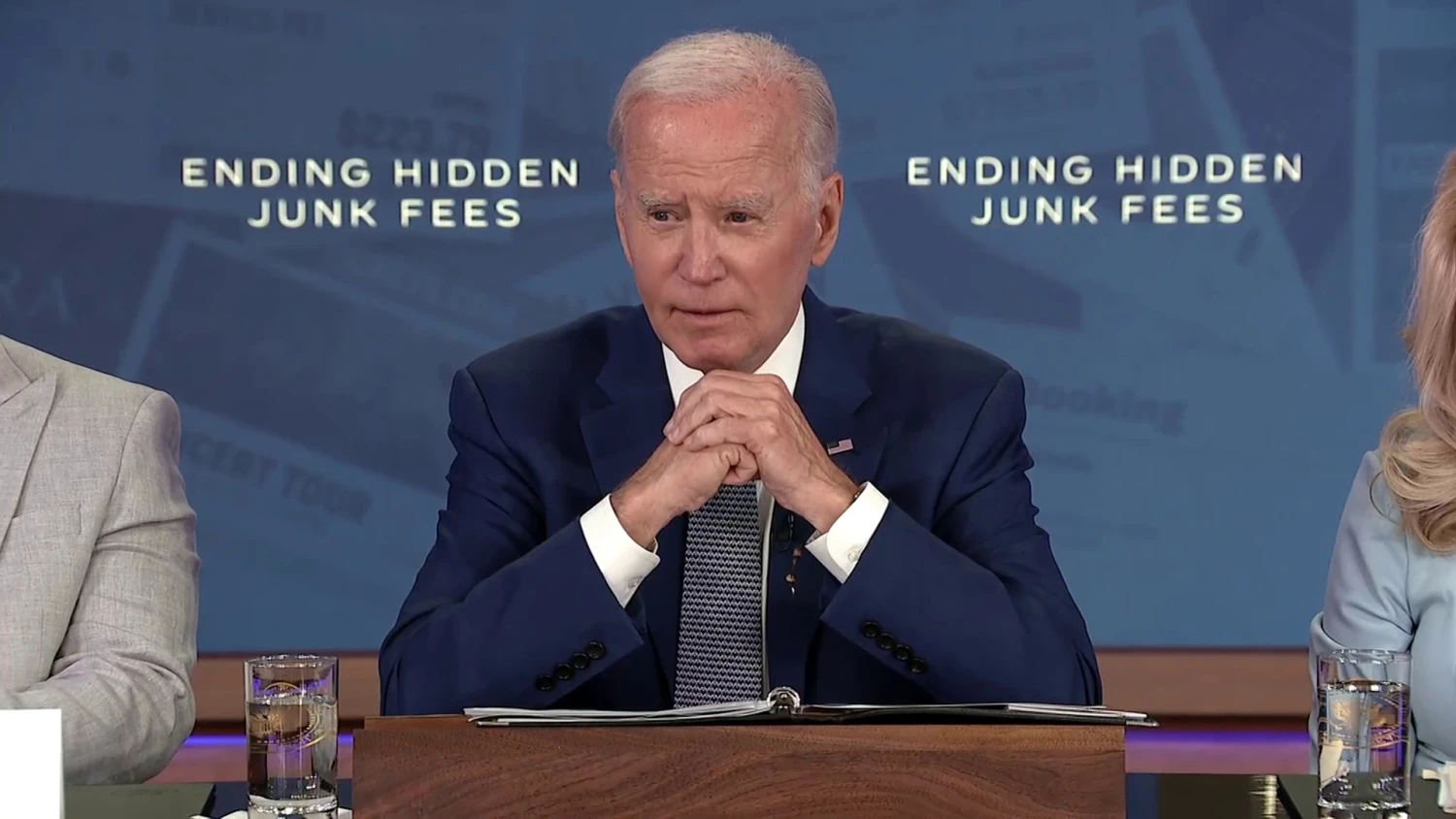

This rule, according to the agency, is expected to diminish American late fee expenses by over $10 billion each year, bringing the average fee down from $32 to $8. Highlighted as a significant achievement in the Biden administration’s campaign against “junk fees,” this initiative seeks to alleviate financial pressures from consumers by curbing “unnecessary charges” from the financial sector.

Echoing the sentiments of the initiative’s broader goals, the White House commended the rule for its part in an ongoing effort to eliminate various unwarranted fees imposed on consumers. “It builds off of steps the CFPB has already taken to crack down on junk fees in the banking sector, including fees for basic customer services and moving to curb overdraft fees and bounced check fees,” stated the White House.

The rule has met with criticism from some political corners, with Senate Banking Committee ranking member Tim Scott (R-SC) defending the role of fees in promoting financial discipline among consumers. Scott announced plans to challenge the rule’s implementation via the Congressional Review Act.

The response from consumer advocacy groups and industry representatives further delineates the divide in opinion over the rule’s impact. Chuck Bell, director of advocacy at Consumer Reports, praised the decision, pointing out the disproportionate effect of late fees on economically vulnerable demographics. On the flip side, major banking and business lobbying groups, including the US Chamber of Commerce and the American Bankers Association, have voiced strong opposition, cautioning against potential adverse effects on consumer financial behavior.